24

8.- Financial assets (non-current and current)

8.1 Non-current financial assets

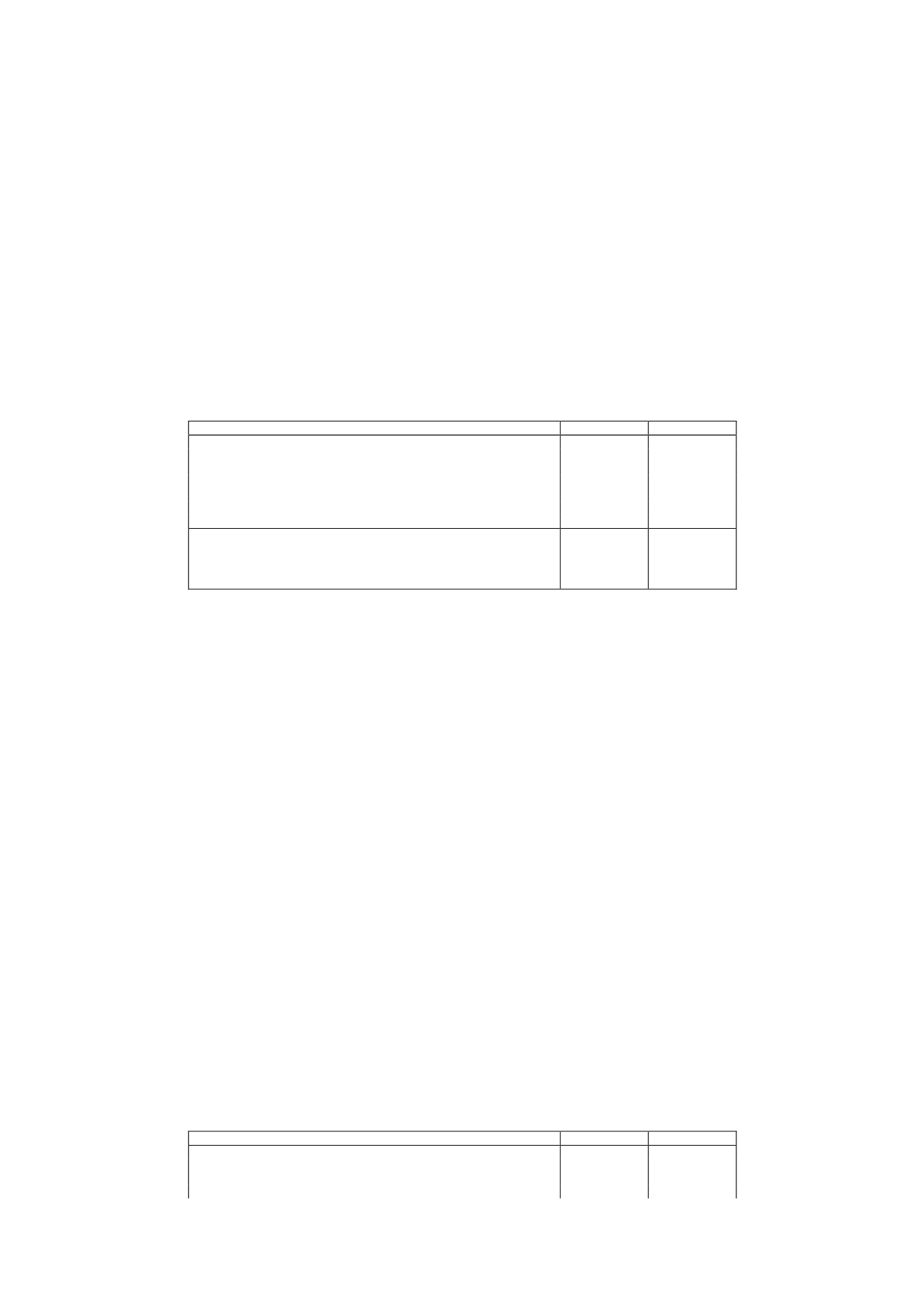

The detail of “Non-Current Financial Assets” at the end of 2015 and 2014 is as follows (in

thousands of euros):

2015

2014

Held-for-trading financial assets:

Hedging derivatives (Note 10)

2,770

4,397

Other derivatives

-

87

Available-for-sale financial assets:

At cost (Note 19.2)

11,531

5,956

Loans and receivables:

Long-term guarantees and deposits

118

75

Total

14,419

10,515

In relation to “Other Derivatives”, in December 2012 the Company entered into several

agreements with the former shareholders of Gestora de Inversiones Audiovisuales La Sexta, S.A.,

including one whereby, in exchange for a fixed market consideration determined at the date of the

agreement and deliverable by Atresmedia Corporación de Medios de Comunicación, S.A.

(premium), the aforementioned counterparty undertook to pay the Company a variable cash

amount to be determined on the basis of the future economic results of Atresmedia and payable in

2017.

On 24 February 2014, as a result of the negotiation process for the novation agreement described

in Note 12.2 and forming part thereof, other agreements were reached with Gamp Audiovisual,

S.A. and Imagina Media Audiovisual, S.L. consisting of the cancellation of their proportional share

of the financial derivative agreement. At 31 December 2014, the balance included the fair value at

that date of the derivative financial instrument arranged with Gala Desarrollos Comerciales, S.L.,

the terms and conditions of which are unchanged, as indicated in Note 12.2.

"Available-For-Sale Financial Assets" includes non-current financial investments in the equity

instruments of companies over which the Company does not exercise significant influence under

Rule for the Preparation of Financial Statements no. 13 since it does not participate in the process

to set financial or commercial policies. The increase in this heading relates to the Company's

strategy to diversify the avenues for growth other than advertising income, by means of

investments using the model whereby the broadcasting of advertising is exchanged for an

ownership interest in a company. Noteworthy among the companies in which such investments

have been made are Eshop Venture, S.L. and Kzemos Technologies, S.L. (see Note 19.2).

8.2 Current financial assets

The detail of “Current Financial Assets” at the end of 2015 and 2014 is as follows (in thousands of

euros):

2015

2014

Derivatives:

Derivatives (Note 10)

13,112

11,740

Available-for-sale financial assets:

At cost (Note 19.2)

260

2,211