48

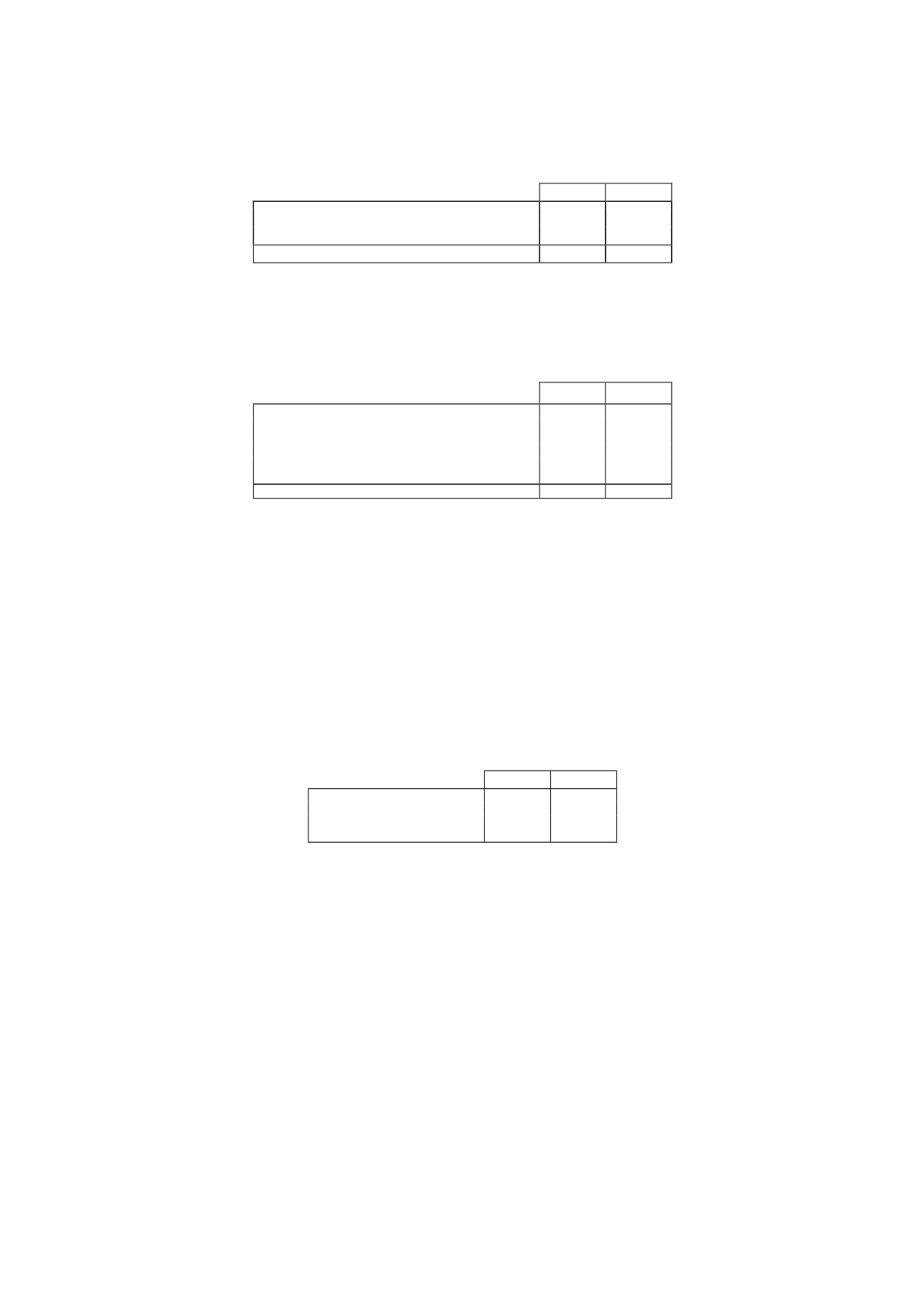

18.3 Employee benefit costs

The detail of "Employee Benefit Costs" in 2015 and 2014 is as follows:

2015

2014

Employer social security costs

5,392

5,309

Other employee benefit costs

1,174

1,289

6,566

6,598

18.4 Other operating expenses

The detail of “Other Operating Expenses” in the statements of profit or loss for 2015 and 2014 is

as follows:

Thousands of euros

2015

2014

Work performed by other companies

58,873

55,217

Rent and royalties

55,153

58,578

Communications

9,974

7,676

Advertising and publicity

9,841

8,655

Copyrights and other expenses

72,102

39,750

Total

205,943 169,876

“Rent and Royalties” includes mainly, inter alia, the amounts paid to Retevisión I, S.A. for the

audiovisual signal distribution and the contribution of the television operators to the financing of

Corporación RTVE.

“Copyrights and Other Expenses” includes changes in the allowance for doubtful debts. In 2015

the Company recognised provisions amounting to EUR 2,114 thousand and used provisions of EUR

9 thousand (2014: EUR 979 thousand used).

18.5 Finance income and finance costs

The detail of the finance income and finance costs calculated by applying the effective interest

method is as follows (in thousands of euros):

2015

2014

Finance income

29,489

9,901

Finance costs

11,435

13,456

EUR 23,220 thousand of total finance income for 2015 relate to dividends received by Atresmedia

Corporación de Medios de Comunicación, S.A. from its subsidiaries (2014: EUR 3,359 thousand)

(see Note 8.3).

18.6 Changes in fair value of financial instruments

“Net Gain (Loss) due to Changes in the Value of Financial Instruments at Fair Value” in the

statement of profit or loss includes mainly the net gain (loss) due to the change in fair value of the

currency hedges and interest rate swaps (IRSs) detailed in Note 10 to these consolidated financial

statements and the negative impact arising from the recognition at fair value of the non-current

payables to suppliers included under "Other Non-Current Payables" (see Note 14.1).