In addition to the above amendments, there has also been a change to IFRS 1, First-time

Adoption of International Financial Reporting Standards.

The entry into force of these amendments did not have any impact for the Group.

Standards and interpretations issued but not yet in force:

At the date of preparation of these consolidated financial statements, the most significant

standards and interpretations that had been published by the IASB but which had not yet

come into force, either because their effective date is subsequent to the date of the

consolidated financial statements or because they had not yet been adopted by the European

Union, were those listed below.

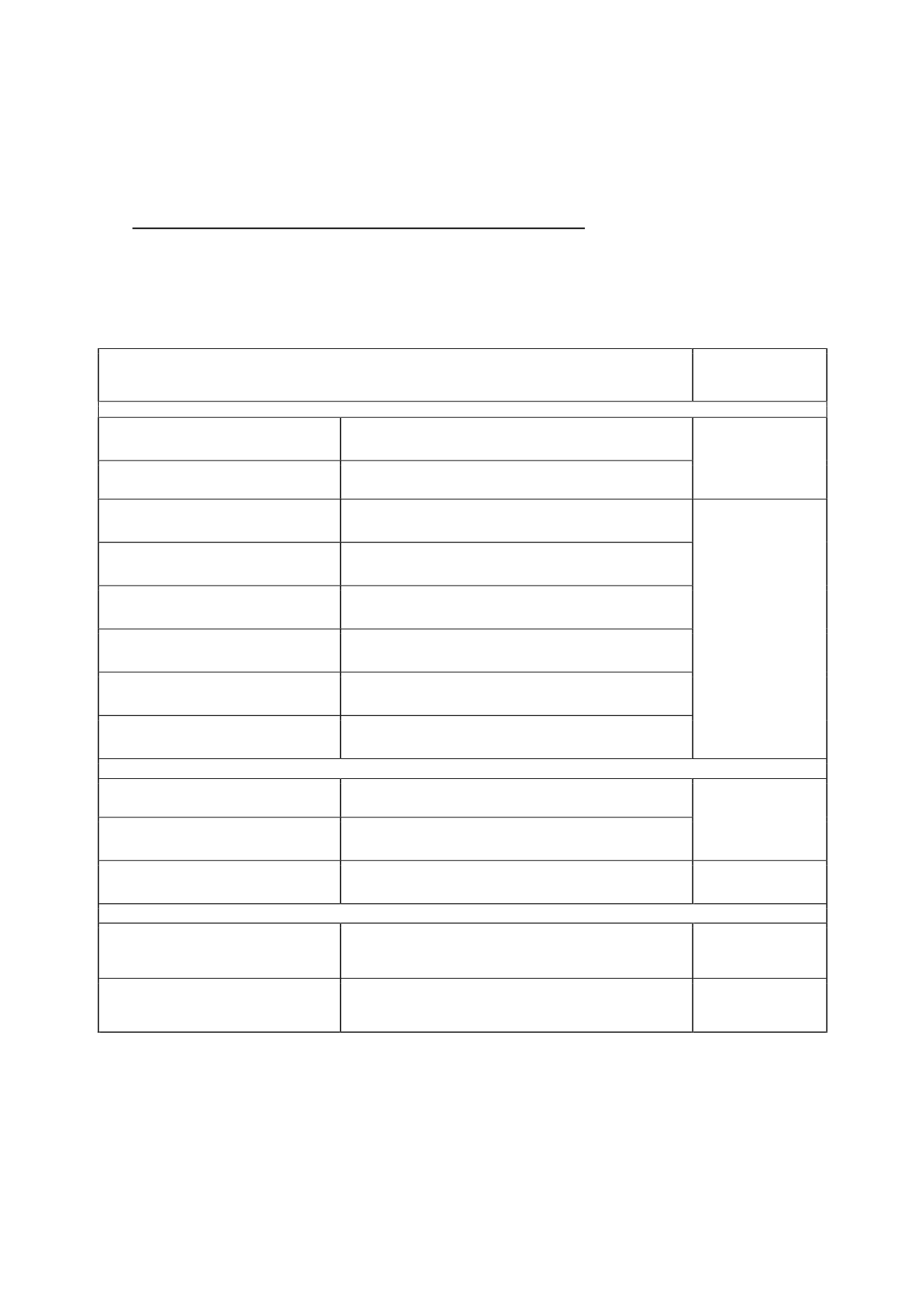

New standards, amendments and interpretations:

Obligatory application

in annual reporting

periods beginning

on or after:

Approved for use in the European Union

Amendments to IAS 19, Defined Benefit Plans:

Employee Contributions (issued in November

2013)

The amendments were issued to allow employee contributions to be

deducted from the service cost in the same period in which they are

paid, provided certain requirements are met.

1 February 2015 (1)

Improvements to IFRSs, 2010-2012 cycle (issued

in December 2013)

Minor amendments to a series of standards.

Amendments to IAS 16 and IAS 38 - Clarification

of Acceptable Methods of Depreciation and

Amortisation (issued in May 2014)

Clarify the acceptable methods of depreciation and amortisation of

property, plant and equipment and intangible assets, which do not

include methods that are based on revenue.

1 January 2016

Amendments to IFRS 11 - Accounting for

Acquisitions of Interests in Joint Operations

(issued in May 2014)

Provide guidance on the accounting for acquisitions of interests in joint

operations in which the activity constitutes a business.

Amendments to IAS 16 and IAS 41 - Bearer

Plants (issued in June 2014)

Bearer plants shall be measured at cost rather than at fair value.

Improvements to IFRSs, 2012-2014 cycle (issued

in September 2014)

Minor amendments to a series of standards.

Amendments to IAS 27, Equity Method in

Separate Financial Statements (issued in August

2014)

The amendments permit the use of the equity method in the separate

financial statements of an investor.

Amendments to IAS 1, Disclosure Initiative

(issued in December 2014)

Various clarifications in relation to disclosures (materiality, aggregation,

order of specific items within the notes to the financial statements, etc.).

Not yet approved for use in the European Union at the date of publication of this document: New standards

IFRS 15, Revenue from Contracts with Customers

(issued in May 2014)

New revenue recognition standard (supersedes IAS 11, IAS 18, IFRIC

13, IFRIC 15, IFRIC 18 and SIC-31).

1 January 2018

IFRS 9, Financial Instruments (last phase issued

in July 2014)

Replaces the requirements in IAS 39 relating to the classification,

measurement, recognition and derecognition of financial assets and

financial liabilities, hedge accounting and impairment.

IFRS 16, Leases (issued in January 2016)

The new standard on leases that replaces IAS 17. A lessee shall

recognise all leases in its balance sheet as if they were financed

purchases.

1 January 2019

Amendments and/or interpretations

Amendments to IFRS 10, IFRS 12 and IAS 28,

Investment Entities (issued in December 2014)

Clarifications on the consolidation exception for investment entities.

1 January 2016

Amendments to IFRS 10 and IAS 28, Sale or

Contribution of Assets between an Investor and

its Associate or Joint Venture (issued in

September 2014)

Clarification in relation to the gain or loss resulting from such

transactions involving a business or assets.

No date has been set

(1)

The IASB established that these amendments and improvements would come into force on or after 1 July 2014.

The directors are assessing the potential impacts of the future application of these standards.

Based on the information available to date, the Group estimates that their entry into force

would not foreseeably have a significant impact on the consolidated financial statements,

except for the following standards: