The 2014 consolidated financial statements, which were approved by the shareholders at

the Annual General Meeting on 22 April 2015 and are included for comparison purposes,

were also prepared in accordance with EU-IFRSs applied on a basis consistent with that

of 2015.

Standards and interpretations effective in 2015:

The standards, amendments and interpretations that came into force in 2015 and that were

taken into account in preparing the accompanying consolidated financial statements are

described below:

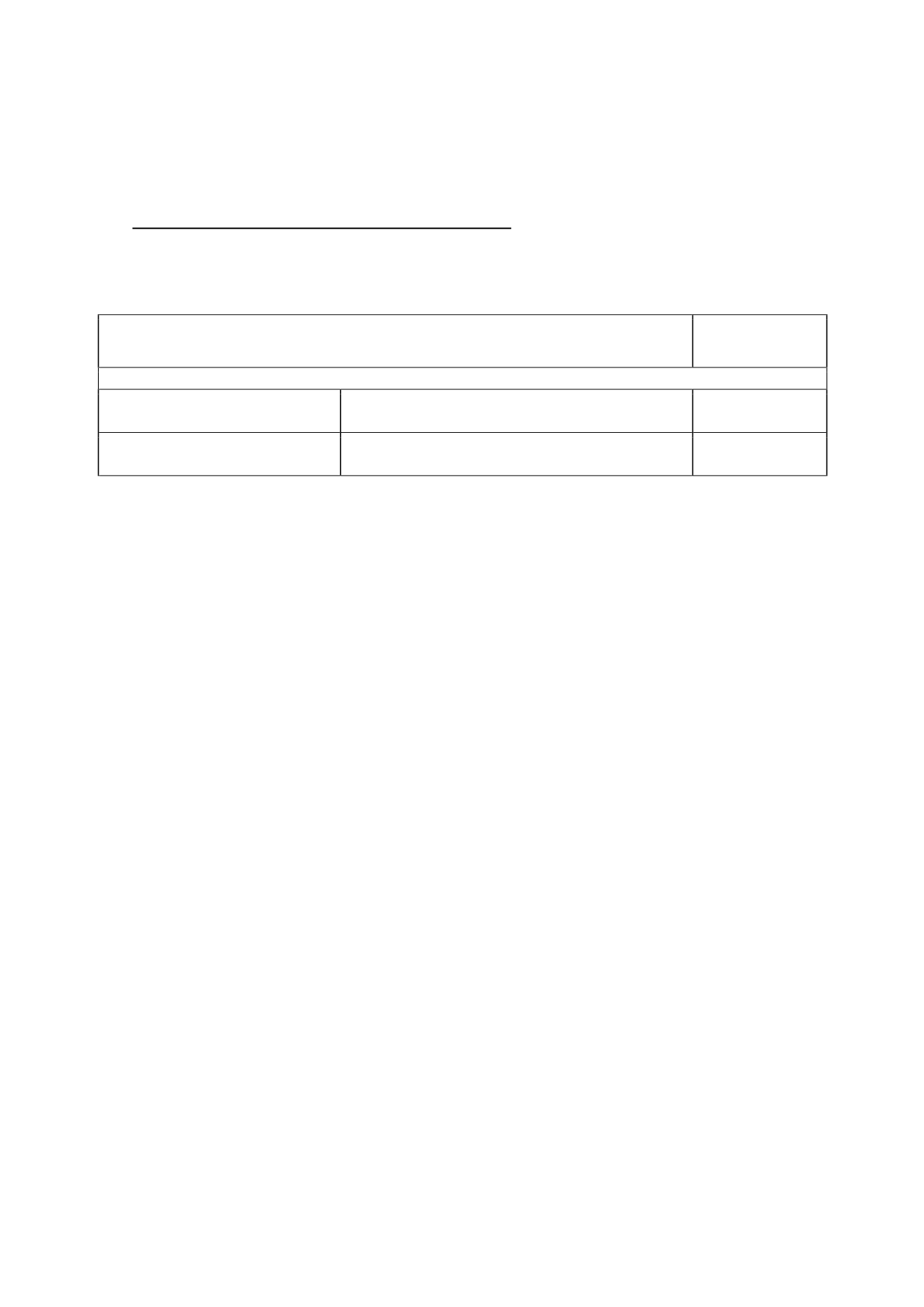

New standards, amendments and interpretations:

Obligatory application

in annual reporting

periods beginning

on or after:

Approved for use in the European Union

IFRIC 21, Levies (issued in May 2013)

This interpretation addresses the accounting for a liability to pay a levy.

17 June 2014 (1)

Improvements to IFRSs, 2011-2013 cycle (issued

in December 2013)

Minor amendments to a series of standards.

1 January 2015 (2)

(1) The EU endorsed IFRIC 21 (EU Journal of 14 June 2014), changing the original effective date established by the IASB (1 January 2014) to 17 June

2014.

(2) The IASB established that these improvements would come into force on or after 1 July 2014.

New standards, amendments and interpretations mandatorily applicable on or after

1 January 2015

IFRIC 21, Levies

The interpretation addressees the timing of recognition of a liability to pay a levy if that

liability is based on financial data for a period other than that in which the activity that

triggers the payment of the levy occurs.

The interpretation states that the liability must be recognised when the obligating event

giving rise to the recognition thereof occurs, which is normally identified by legislation.

The recognition principles outlined above must be applied to both the annual and interim

financial statements. This means that the interim financial statements will not include

any prepaid expense in respect of a levy if there is no present obligation to pay the levy

at the end of the interim reporting period.

The entry into force of this interpretation did not have any impact on the consolidated

financial statements.

Improvements to IFRSs, 2011-2013 cycle

The improvements to this cycle include amendments to the following standards:

IFRS 3, Business Combinations: amendment to the scope of the standard in relation to

joint ventures, which clarifies that IFRS 3 does not apply to the formation of a joint

arrangement in the financial statements of the joint arrangement itself.

IFRS 13, Fair Value Measurement: amendment to the scope of portfolio measurement.

The scope of this exception for measuring the fair value of groups of financial assets and

financial liabilities on a net basis was amended to clarify that the references to financial

assets and financial liabilities should be read as applying to all contracts within the scope

of IAS 39 or IFRS 9, regardless of whether they meet the definitions of financial assets or

financial liabilities in IAS 32.

IAS 40, Investment Property: interrelationship with IFRS 3. The amendments clarify that

IAS 40 and IFRS 3 are not mutually exclusive and both standards may have to be

applied.